Back to selection

Back to selection

Fraud Alert

This piece was originally printed in the Fall 2010 issue. Inside Job is nominated for Best Documentary.

Charles Ferguson follows up his hard-hitting Iraq War documentary, No End in Sight, with another investigative look at a complicated and controversial subject: the global economic crisis. In Inside Job, Ferguson indicts the growth of the banking industry for causing the global economic crisis, asking why not a single person has gone to jail because of it.

With his debut picture, No End in Sight, Charles Ferguson made the essential Iraq War documentary by largely avoiding its most contentious issue — the decision to wage it in the first place. When I interviewed him in 2007, he explained that he was less interested in the political debate that led up to the war than he was its faulty prosecution and the fumbled postwar occupation. No matter what one’s political persuasion, it was hard not to be enraged by Ferguson’s depiction of the poor decision making, rampant cronyism and ideologically-driven strategies that led to years of violence and lost American and Iraqi lives.

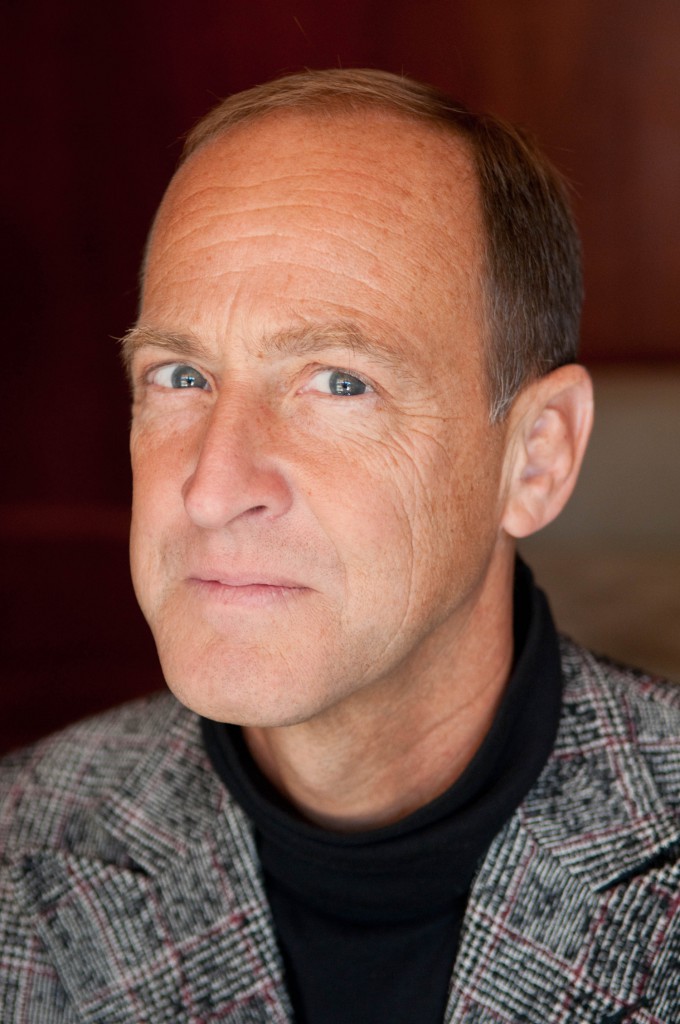

With his second film, Inside Job, Ferguson, a former high-technology consultant to the government and private sector whose software company Vermeer Technologies was purchased by Microsoft in 1996, has reversed his approach — the film is all buildup to an event we are only now just beginning to understand the long-term repercussions of. Using crisply shot interviews with many key players, archival footage, charts, and snappy music-driven montages, Ferguson walks us through the sometimes dizzying world of collateralized debt obligations, credit default swaps and subprime mortgages, illustrating how the growth of the banking industry over decades led to the breakdown of our global economy. And while this story has been told in countless magazine articles, some books and a few other documentaries (mostly TV), Ferguson adds new dimensions. In one segment he interviews heads of Ivy League business schools, nailing them for providing in their commissioned research papers the academic cover for the most egregious banking offenses while not informing their readers of their own financial conflicts of interest.

But while Inside Job works as a concise history lesson, Ferguson’s ultimate goal is a bigger one. As the film’s title suggests, the director clearly defines the actions of the bankers and mortgage industry as criminal, wondering why crimes that fleeced $2 trillion dollars from pension funds, investment accounts, home equity and the Federal Reserve balance sheet haven’t sent a single person to jail. Arguing that indictments are necessary, he even goes so far as to suggest that prosecutors use the black books of high-class escort agencies to flip lower-level investment bankers against their bosses. As Ferguson explains here, criminal prosecution may not just be the right thing to do from a law and order perspective, but it may also be what’s needed for the rebuilding of our economy. I interviewed Ferguson in the Sony Pictures Classics office (which currently has the film out in limited release) on the two-year anniversary of Lehman Brothers’ collapse.

Has Inside Job changed since you premiered it at Cannes in May? Yes, very slightly. We changed a total of about a minute to account for two things. I wanted to make brief reference to the financial reform bill in its final form. Also, a few more things have come out, and we put one of them in the film, namely that when [then Treasury Secretary Henry] Paulson and [Chariman of the U.S. Federal Reserve Ben] Bernanke rescued AIG, we learned that a condition of the [government] giving money for the rescue was that AIG waive its right to sue the investment banks for fraud. And just coincidentally, that included suing Goldman Sachs, which Paulson had been CEO of when Goldman had purchased the credit default swaps that were being paid off. I didn’t say this in the film, but this was a case where Secretary Paulson was protecting himself personally against being sued. I thought that was a noteworthy addition.

After making a film about the aftermath of the Iraq War, I suppose doing one on the financial crisis is an obvious choice given the enormity of its effect on the world economy. But it’s still a difficult subject matter to portray in a film. Why did you decide to make Inside Job? I actually started thinking about it in late 2007, which was still early, but before the crisis. A couple of people who are in the film and who are among the people who warned me about the crisis in advance are friends of mine: Charles Morris and Nouriel Roubini. Charles Morris wrote a book about the then-impending crisis, The Trillion Dollar Meltdown. It was published in February 2008 but he sent me the manuscript in late 2007. He published a second edition a year later, The Two Trillion Dollar Meltdown, at which point I told him, “Charlie, no more editions, it’s getting expensive!” [laughs] I remember calling up Charlie after I read the manuscript and saying, “You know, Charlie, this is kind of alarmist, kind of extreme. A trillion dollars?” And he said, “Charles, just you wait.” When major investment banks start failing on a regular basis, I began to pay attention. I had become somewhat obviously disconnected from the financial world, but I’d had some experience. My PhD thesis advisor was an economist, and I had actually done some consulting for investment banks when I was an academic on things related to high-technology companies and markets. So when Lehman and AIG failed, [I thought,] this is just too obvious. This is a huge thing, and I happened to be well-equipped to deal with this. I went to the two guys who run Sony Pictures Classics, and somewhat to my surprise, they were immediately interested. I think it has something to do with the fact that Michael Barker has a personal interest in investing and finance, and he follows these things more than your average film distributor might be expected to.

Did they finance the film or just come on board for distribution? They partially financed it. They purchased worldwide rights, and partially financed it.

Once you decided to tackle this subject matter, what were your goals as a filmmaker with regards to its treatment? Well, I tried — you and others can judge whether or not I succeeded — but I tried to make a movie more than a documentary. I tried to make something that not just was informative, but that was interesting and dramatic, that had cool images and cool music, that was engaging to watch. I hope I succeeded.

I absolutely found the film all of those things, but at the same time, it is a movie about ideas, and it’s not character-based. So much of documentary these days is character-based, which some people find more accessible. I suppose if you had tried very hard you could have threaded an interesting character throughout the whole movie. I’m not sure who that person would’ve been. Maybe Nouriel Roubini. But you didn’t do that. Had you ever thought of a different approach to make it “more of a movie”? I did. And Nouriel was one person I thought of. I even thought of taking a half-dozen representative people: Nouriel, a banker, somebody who’s lost their house, a regulator, a lawyer. I decided not to do that for a couple of reasons. One was, it didn’t seem to me there was a short list of people and characters that would allow the whole story to be told. Some of the people whose points of view I really wanted to be in the film are very busy people. A lot of their work is very confidential, so they’re not going to let me walk around behind them for six months. There was no way that I could’ve shadowed Christine Lagarde, the French finance minister, or Dominique Strauss-Kahn, who runs the IMF, or [Congressman] Barney Frank. I also wanted the visual quality of the film to be high, and vérité footage tends to be of a lower visual quality. That’s changing now. Digital cameras are getting better and smaller. Maybe five years from now, I would have made a different decision. Maybe.

So you had Morris’s and Roubini’s work as sort of source material. What role did your own research then play? Were you primarily following a narrative that you already agreed with? Or was the film shaped by things you learned while making it? We did a huge amount of research for this film. Of course I read Charlie’s books and Nouriel’s articles, and I read lots of other stuff. I’ve spoken with hundreds of people — bankers, economists, journalists, lawyers, many different types of people. By the time we started editing, I had the structure of the film in my mind, kind of half-done. I certainly had some ideas, which were reflected in the final film, but there were many things that came up. Editing the film was a very collaborative process. It was not top down, from me to the editors. The editors, Chad Beck and Adam Bolt, are brilliant guys and they were very much a part of the structuring process.

Was it harder or easier after No End in Sight to get interviews? You came from the business and academic communities when you made that film. Your status as a first-time filmmaker probably gave you a lot of leeway in terms of talking to people. They maybe didn’t expect you to be hard-hitting, and I’m sure some of them were surprised by the thoroughness of your questioning. I think in both cases I was surprised a number of times in both directions. I was surprised by those people who wouldn’t speak with me, and equally surprised by some of the people who would. A couple of people who have seen this film have said to me, “If this film does well, it’s going to be hard for you to ever get another interview.” People who have things to hide, maybe they’ll be more careful in the future. But one reason, in this case, that some of those people agreed to be interviewed, [was because] I think [they had a sense of] arrogance and complacency. They weren’t used to being challenged in the rest of their lives. And there’s a substantial supply of those people in the world.

Walk me a little bit through your interview process. Are you spending hours and hours with people to get what you get, or are you in there for 20 minutes? Had you talked to them before, or were you meeting them on the day? It varied. Some people, not very many, requested a list of the subjects, and I supplied that in a general way. I declined to supply an exact list of questions; I don’t think that’s an appropriate thing to do. I did an enormous amount of research, and often quite a lot of research specific to the person being interviewed — what they had done, what they’d been involved in and what they knew. That was certainly the case with the academic interviewees. I read a lot of their papers, I knew their backgrounds very intimately, I knew what policy questions they’d been involved with, I’d read their public statements, I knew what organizations they worked with — at least to the extent that that’s been publicly disclosed. One of the issues that I discuss in that part of the film is that [these relationships] are not always publicly disclosed. But research was the most important thing. I usually started out with relatively neutral questions, and then after getting the neutral out of the way, began to get more specific and, where it was called for, more argumentative.

Have you heard from the people, any of the subjects in the movie? Everybody who is in the film has been invited to see the film. A fair number of people have. George Soros has not yet, but his chief of staff did. [Former member of the Federal Reserve’s Board of Governors] Frederic Mishkin sent a public relations executive to watch the film in his place.

What sort of economic knowledge did your editors have to have or not have in order to function effectively and to contribute those structuring ideas you spoke about? Neither one of them has a lot of formal training in economics, but they’re both really, really smart. They have an interest in economic and political affairs, and they just picked it up really fast. I mean, not to the same level as me, given my background and all the research I did, but they came to know a great deal. And they certainly understood very thoroughly the underlying principles of what happened and what was going on.

More specifically, what types of judgments or suggestions did they bring to the project? One thing was what to keep in and what to leave out. The first assembly was six hours long, and it could have been three times that length. We have over 70 film interviews. The final film [references] over a hundred documents. We developed this enormous archive of stuff. So just deciding what and who to keep in, that alone was a major thing. Then we developed the film in modules. We decided that there was a list of subjects, facts and episodes that had to be there, and we started creating sequences around them. We would try rearranging them in different order, or connecting them in different ways. Sometimes we would merge them, sometimes we would take one and split it. Some of them we converted into music-video montages. There’s a montage about criminality and finance that’s two minutes long. That started out as a seven-minute narrative sequence. We realized that it could be punchier and more fun, that it could kind of wake people up if it was done in this different way, and [the editors] did that.

The broader discussion of monetary theory, was that something you had in there at one point? No, that was never a serious candidate for inclusion in the film. Mainly on the grounds that I absolutely wanted to keep all economic and financial jargon out of the film, if at all possible. I just thought, it wasn’t the main event, and it’s really technical and dry and dull.

There are other things that you could have gone into but didn’t — for example, the so-called “heroics” of the central bankers, the Treasury Secretary and the Fed Chiefs going into the bank rescue and TARP. You really focused on the growth of the banking industry, the relationships between the banking industry and politics, and, finally, the question of large-scale criminal fraud. I know people like the economist Jamie Galbraith have been discussing this, but I feel like the idea that there should be criminal prosecution of the bankers and mortgage lenders is almost a fringe idea right now. Well, this is the interesting thing — it’s actually not a fringe idea.

It feels like it. You’re right. There’s very little public discussion. But if you talk to people privately, believe me, it’s on their minds.

What kind of people? Lots.

The same people who are worried about being prosecuted? The same people, and also people who feel they should be prosecuted. The film was at Telluride 10 days ago, and one of the people in the audience was a very serious guy in American finance, a billionaire. Incredibly well-connected on Wall Street, has been on the boards of several of the companies that are in the film. After he saw the film, he invited me to dinner. At dinner he said to me, “You know, you’re right. They should go to jail. And a lot of us kind of feel that way.” And then he said, “You know, they realize it too.” And so I asked him, “Why didn’t you say anything out loud about it?” And he said, “Well, you can imagine what would happen to me, my business, my relationships, my life, if I was to start saying this, given my position.” So, I think that’s the answer. There’s very little public discussion of it because people are terrified to mention it. And of course the Obama administration has made a political decision that it’s not going to go in that direction so they don’t want to talk about it. But if you have private conversations with people, the subject comes up quite a lot. Quite a lot.

It leads into something I wanted to ask you, which is about the audience for the film. Who did you make the film for, and who is the audience? Are those two different questions or the same question? Because, quite interestingly, if you inspired a billionaire on the board of directors from one of these companies to consider these issues, that could be almost justification enough. Or let’s say you were able to convince a few of these people. Yes, that is true. I didn’t make the film for them, though. I made the film for the widest possible audience. Forgive me if this sounds pretentious. I made the film so that the American people could understand what was done to them. So I hope that it will be seen by lots of people, not just people in finance and government. You tell me, do you think that people will go to see this film?

Well, I hope so. But there’s no question that film is in a little bit of an existential crisis right now and you have to ask, is film the medium that is going to reach the widest group of people? I guess it’s a question that you’ve answered for yourself simply by making the film. Do you believe that film is that medium at the moment, the one that will reach that widest audience? Or is it more that you are a filmmaker, and that’s what you do? It’s a combination of the two. I am a filmmaker now. It is what I do. I could have stopped being a filmmaker and tried writing a book, but I think this is better. There have been lots of books about the crisis, some better than others. But people don’t read books, in general. Some of the books have been popular but I think, and I certainly hope, that more people will see this film than would have read an equivalent book.

How do you promote a film like this? Are you the front person for the campaign? I guess that one would say that, yes.

Progressive groups will obviously be interested in this film, but what about the business press? Are you going on CNBC and Fox Business News? Fox, I believe not yet. We’re trying to do that. I’ve been interviewed by Bloomberg, and I’ve been on the Bloomberg website. I think I am scheduled to be on CNBC pretty soon. And I’ve spoken already with a considerable number of financial journals and financial magazines. I’m optimistic that the financial press will be there. The question of liberal vs. conservative. I myself don’t view it as a liberal or conservative film. How the world sees it, I don’t know.

One big topic in the documentary world is transmedia, which involves a film’s subject matter being dispersed and actually told through multiple platforms, not just films. Are there other places that content related to Inside Job will appear? There’s certainly going to be a website, which is going to have a lot of stuff on it, a lot of links to an enormous number of documents that we went through in order to do the research for the film. Hundreds, maybe thousands — I haven’t counted. And it will also have some other material: summary material, and copies of some of the letters that we wrote in the course of making the film. For example, we sent very detailed letters to the presidents of Harvard and Columbia asking many, many questions about the conduct of their faculty members and their universities’ conflict of interest policies. We also sent equivalently detailed letters to many faculty members. There are some e-mail exchanges with the investment banks.

When did you start working on this site? This isn’t something that you throw out a month before the movie opens. We maintained an internal database of this material as we were doing research for the film. We had a full-time research person, and two or three part-time research people collecting materials, organizing them, archiving them. It was actually fairly easy to take that [material] and hand it over to the website.

Did your background in the software industry help? No. What we did was very, very simple. Technologically, it’s very unimpressive. But just a very light touch proved to be enough. The majority of it was a Word document, with links and explanations.

I guess the film leaves you with the question, “Where do we go now?” As it shows extremely well, the growth of the banking sector in the past decades caused instability in the system. But in the latter part of those same years, securitization also caused easy credit to be available, and that credit fueled the growth of the American economy. When you look forward to the future of the American economy, it seems to me you have to reconsider the growth paradigm because it’s not clear where future growth is going to come from. People talk about things like green energy that could provide growth, but mostly it seems that economic policy is about reverting us back to old patterns. You’re totally right. I think America is quite troubled economically now, and I think it’s going to remain so for quite a long period of time. I’m more optimistic than people who say we’re in for a hopelessly lost decade, like Japan. I think there’s — call it a quarter of the American economy that is very, very dynamic, aggressive and competitive and produces very high rates of technical progress and growth. The information technology, the web sector, that part of the economy we still have that so I don’t think we’re going to stagnate forever. But on the other hand, as the film very briefly points out, that part of the economy is only available to a small fraction of the population. It’s perfectly open to someone who’s got a master’s in computer science from M.I.T., but it’s not open to most Americans. Housing, construction and real estate were the things that many Americans could work in, and now they’re gone. And manufacturing is very troubled. Yeah, I think America’s a very economically troubled place, and I’m very disappointed in the Obama administration’s response.

What can people do? What are the actions that regular people, people outside of the financial industry, can do after seeing your movie? Well, there’s many. You can support existing organizations that work on these things. You can start a new organization.

When you say an organization, you’re talking about the one you mentioned in the film, The Greenlining Institute? Greenlining is one organization that works on these issues, but there are a number of others. The Center for Responsible Lending, the Center for Responsive Politics, the Center for Public Integrity. They all work either on issues related to finance, or on the role of money in politics. Fifty years ago, there were no environmental regulations, there was no environmental movement, and the environment was a very technical issue. Supposedly you had to understand chemistry and physics to know about pollution control and environmental regulation. But people started getting upset about it, and people wrote books and they formed organizations, and now we have an environmental movement and environmental regulation. I think this has to be like that. It would not totally surprise me if a third-party movement of some kind [emerges], another political party, in the way that we now see the Tea Party on the right. Not that I think of this as a right vs. left issue. I view it as kind of honesty vs. corruption thing more than anything else. In some ways, the Social Democratic Party in Britain is kind of a model for what someone might try to do. I don’t know.

It’s bizarre to me that, at least in the media’s eyes, the Tea Party seems to have successfully draped themselves in a populist mantle. It’s disappointing that that’s the direction that popular outrage so far has taken. But I’m not despondent or cynical about that. When I speak with people, I sense a great deal of anger about this situation. People understand that something wrong occurred and it hasn’t been addressed. I hope the film will help verify that.

Today is the anniversary of the collapse of Lehman Brothers. Do you think the government should have bailed Lehman out? Yes, but with very tight strings attached — not the way bailouts have been done. You can bail out Lehman Brothers, the firm, while not also bailing out Richard Fuld and letting him walk away with his half a billion dollars. It would have been perfectly possible to take back a lot of the money that these guys made, and I’m very disappointed that that wasn’t done. But yes, Lehman should not have been allowed to fail.

Do you think the government should have put the banks in receivership? Possibly. But even if they weren’t forced into receivership, at one point the federal government owned more than 60 percent of Citigroup. If you own more than 60 percent of a bank, you can dictate what the bank does. You can have a say about who its management and what their compensation is. None of that was done, and that’s bad.

Do you have any hope for the consumer-protection board, or is that sort of a political sideshow? At the margin, it would be helpful, and I certainly admire Elizabeth Warren. But it’s one agency, it’s housed within the Federal Reserve, and its powers are limited. It addresses only consumer issues. Consumer issues are important, but much of this [crisis] has occurred between investment banks and financial institutions, and consumer protection would not address that. And consumer protection for strictly financial products doesn’t affect the fact that we still have a 10 percent unemployment rate. So I don’t think it’s going to change the situation very much.

The film ends with a little bit of a “call to arms,” advocating that the individuals responsible for these criminal acts be brought to some kind of justice. Is that in your mind a precondition to solving these broader economic problems, or does it just have more to do with American ideals of justice? Well, no, they’re related. Fairness and justice are important, but they are also important as an economic policy issue. One reason is, if these people remain as powerful as they currently are, they are not going to be a progressive force of economic policy in America. Their concerns are not the concerns of most Americans who are worried about paying for their kids’ education, and will they be able to get a decent job when they graduate and so forth. That’s one thing. I certainly think that we need to regulate financial services more tightly than we currently do, but there’s something else that’s worth pointing out. Even if we didn’t enact better regulations, I have a funny feeling that conduct would be better, and people would behave differently, if a couple hundred of the most senior executives of the investment banking industry went to prison for the rest of their lives. I think that would make people think a little more about how they conduct themselves. So I actually think it’s an important systemic policy issue. It’s not just a matter of people getting away with something. We have a system of justice that is not just to address past problems, but also [to provide] deterrents, and these people don’t feel deterred.